* An exclamation mark on behalf of the fund indicates that according to its investment policy, it may be exposed to credit risk arising from exposure to bonds that are not rated in an investment rating (as defined below) or from derivatives with or through corporations that belong to the second credit risk group, or from the deposit of cash and deposits with such corporations, or from the value of a foreign security borrowed through an Israeli stock exchange member who does not meet On the conditions set forth in the first credit risk group (hereinafter – exposure to banks and brokers), in the following circumstances or at the following rates: Total rate of exposure to bonds that are not rated in investment rating and exposure to banks And brokers may exceed the fund’s maximum exposure rate to equities, as per the fund’s exposure profile; The exposure rate to a particular bank or broker may exceed 10% of the value of the fund’s assets and the exposure rate Banks and brokers may exceed 20% of the value of the fund’s assets (all regardless of the fund’s exposure profile to shares (for this purpose, first or second credit risk group – as defined in the appendix to the directive for managers). Funds and trustees regarding custodial risks and credit risks.

For this matter:

– “First or Second Credit Risk Group” – As defined in the appendix to the directive for fund managers and trustees regarding custody and credit risks.

– “Bonds of Companies with No Connection to Israel” – In accordance with the effective dates set out in the Israel Securities Authority directive to fund managers regarding disclosure in the fund name about potential exposure to non-investment-grade bonds, bonds of companies with no connection to Israel, and banking corporations where the fund’s cash and deposits are held (New Version – 2021).

– “Company with No Connection to Israel” – A company that meets all the following: (1) its bonds are listed for trading in Israel; (2) it is incorporated outside of Israel; (3) its shares have not been offered to the public in Israel; (4) its business operations are conducted outside of Israel. For this purpose, a company will be considered as conducting business operations in Israel if its CEO or its active chairman (a chairman of the board employed in the position at more than 50% capacity) is an Israeli resident and most of its board members are Israeli residents.

– A rating of AAil or an equivalent rating as mentioned above – does not include a rating of (AAil-) or an equivalent rating.

“Non-Investment-Grade Bond” – Corporate bonds and/or government bonds issued by a country other than Israel that are either unrated or rated below (BBB-) or an equivalent rating.

** Until 22.06.25, the fund was named Fortune (0B) Investment Grade Portfolio.

*** In the assessment of the external investment consultant.

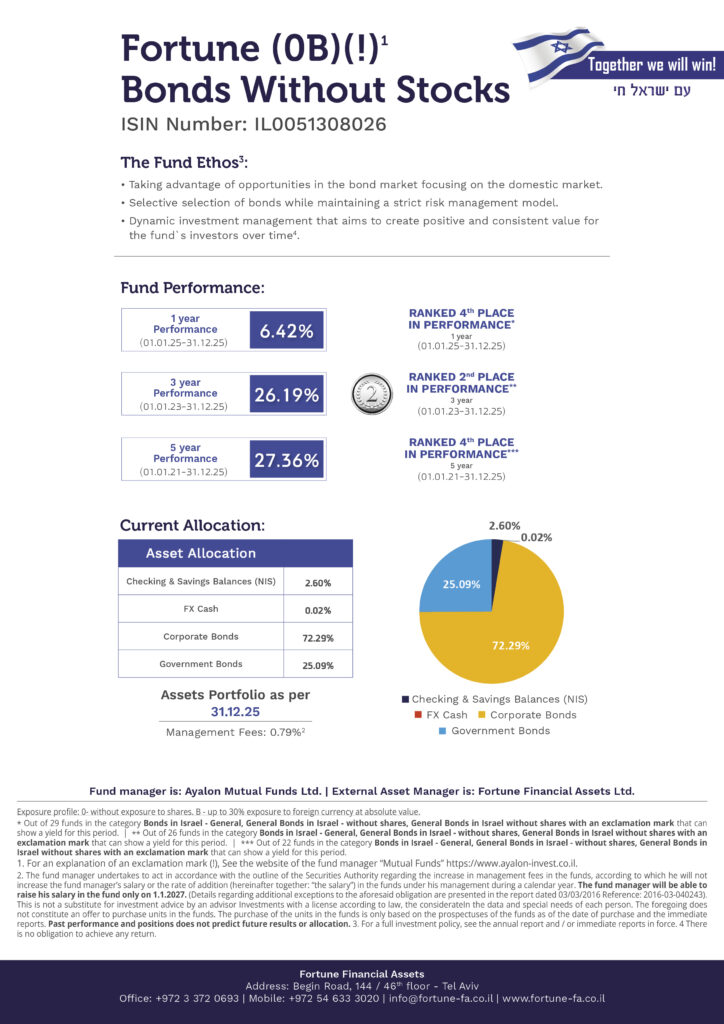

Exposure Profiles:

0 – No exposure to shares at absolute value 1 – Up to 10% exposure to shares at absolute value 2 – Up to 30% exposure to shares at absolute value 4 – Up to 120% exposure to shares at absolute value 6 – Over 200% exposure to shares at absolute value

B – Up to 30% exposure to foreign currency at absolute value D – Up to 120% exposure to foreign currency at absolute value F – Over 200% exposure to foreign currency at absolute value.

The foregoing does not constitute a substitute for investment advice by an investment consultant licensed by law, who takes into account the data and special needs of each person. The foregoing does not constitute an offer to purchase units in the fund. The purchase of units in the fund is only based on the fund’s prospectus valid at the time of purchase and the immediate reports. The foregoing does not guarantee any return, including excess return.